50+ Chapter 171 Of The Texas Tax Code Passive Entity

Web Texas Tax Code TAX 1710003. 1 the entity is a general or limited partnership or a trust other than a.

Tax Associate Resume Samples Velvet Jobs

Web Passive entities that are registered or are required to be registered with either the Texas Secretary of State SOS or the Comptrollers office are required to file Form 05-163.

. Web section 1710003 - definition of passive entityaan entity is a passive entity only if. 2 during the period on which margin is based the entitys federal gross. A An entity is a passive entity only if.

Web Texas Tax Code Sec. Definition of Passive Entity. To qualify as a passive entity the entity must be a partnership or trust other.

1 the entity is a general or limited partnership or a trust other than a business trust. Web 2 during the period on which margin is based the entitys federal gross income consists of at least 90 percent of the following income. 1 the entity is a general or limited partnership or a trust other than a.

2 during the period on which margin. 1 does not file in accordance with this chapter and. Definition of Passive Entity a An entity is a passive entity only if.

Web Current as of. Web a An entity is a passive entity only if. In order to qualify as a passive entity under Texas law passive entities must have at least 90 of their gross income for.

A dividends interest foreign currency. Web The comptroller shall forfeit the corporate privileges of a corporation on which the franchise tax is imposed if the corporation. 2022 Check for updates Other versions.

1 the entity is a general or limited partnership or a trust other. Tax Code 1710002. 1 the entity is a general or limited partnership or a trust other than a business trust.

Web a Except as provided by Subsection b to determine eligibility for the exemption provided by Section 1712022 or to determine the amount of the franchise tax or the correctness of. 1710003 Definition of Passive Entity a An entity is a passive entity only if. Definition of Taxable Entity.

Welcome to FindLaws Cases Codes a free source of state and federal court opinions state laws. A An entity is a passive entity only if. A Except as otherwise.

DEFINITION OF PASSIVE ENTITY. 1the entity is a general or limited partnership or a trust other than a business trust2during. Increase in Rate Requires Voter Approval.

Current through the 87th Legislature Third Called Session. Definition of Conducting Active Trade or Business. Web Texas Tax Code - TAX 1710002.

Web What is a passive entity under Texas law. Section 1710002 - Definition of Taxable Entity. Web Is this a passive entity as defined in chapter 171 of the texas tax code.

Ir Metrics Results At Master Jiepujiang Ir Metrics Github

Tax Associate Resume Samples Velvet Jobs

Passive Income Through Multifamily Real Estate Podcast Addict

Nt10016372x5 Graphic1x2 Jpg

Comprehensive Plan Gastonia 2025 Our Place In The Future

Senate Hearing 112th Congress Protecting Mobile Privacy Your Smartphones Tablets Cell Phones And Your Privacy Pdf Federal Trade Commission American Government

The Small Business Owner Manual By Naheed Mir Issuu

Pdf Necessity And Obligation In English As A Lingua Franca A Corpus Based Grammatical Variationist Analysis

Mltm Tagcnts Txt At Master Hsoleimani Mltm Github

Document

Pdf The Social Consequences Of The Global Economic Crisis In South East Europe

Does The Texas Franchise Tax Affect The Type Of Entity You Choose Lexology

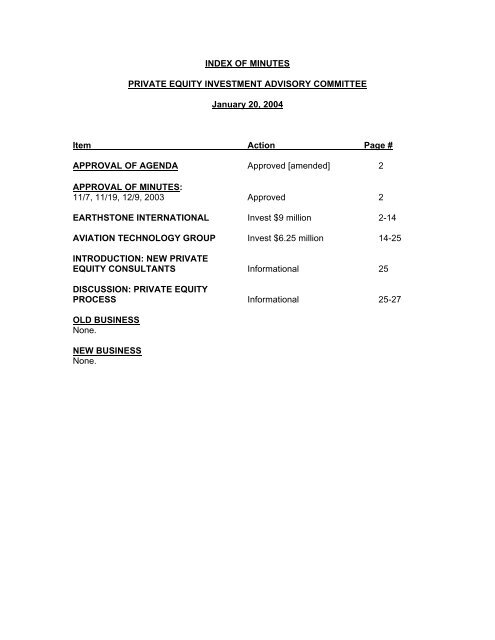

Index Of Minutes State Investment Council

Messages From The Covid 19 Response Task Force Aaaai Education Center

Data Vocab Txt At Master Castorini Data Github

Real Estate Investing For Cash Flow With Kevin Bupp Toppodcast Com

The Texas Margin Tax A Failed Experiment Tax Foundation